Breno Braga, Signe-Mary McKernan

November 20, 2025 - Urban Institute

During the more than three-year student loan payment pause, national delinquency rates dropped from 11.6 percent to 2.3 percent. But now, two years after payments restarted, millions of Americans are once again behind on their student loans.

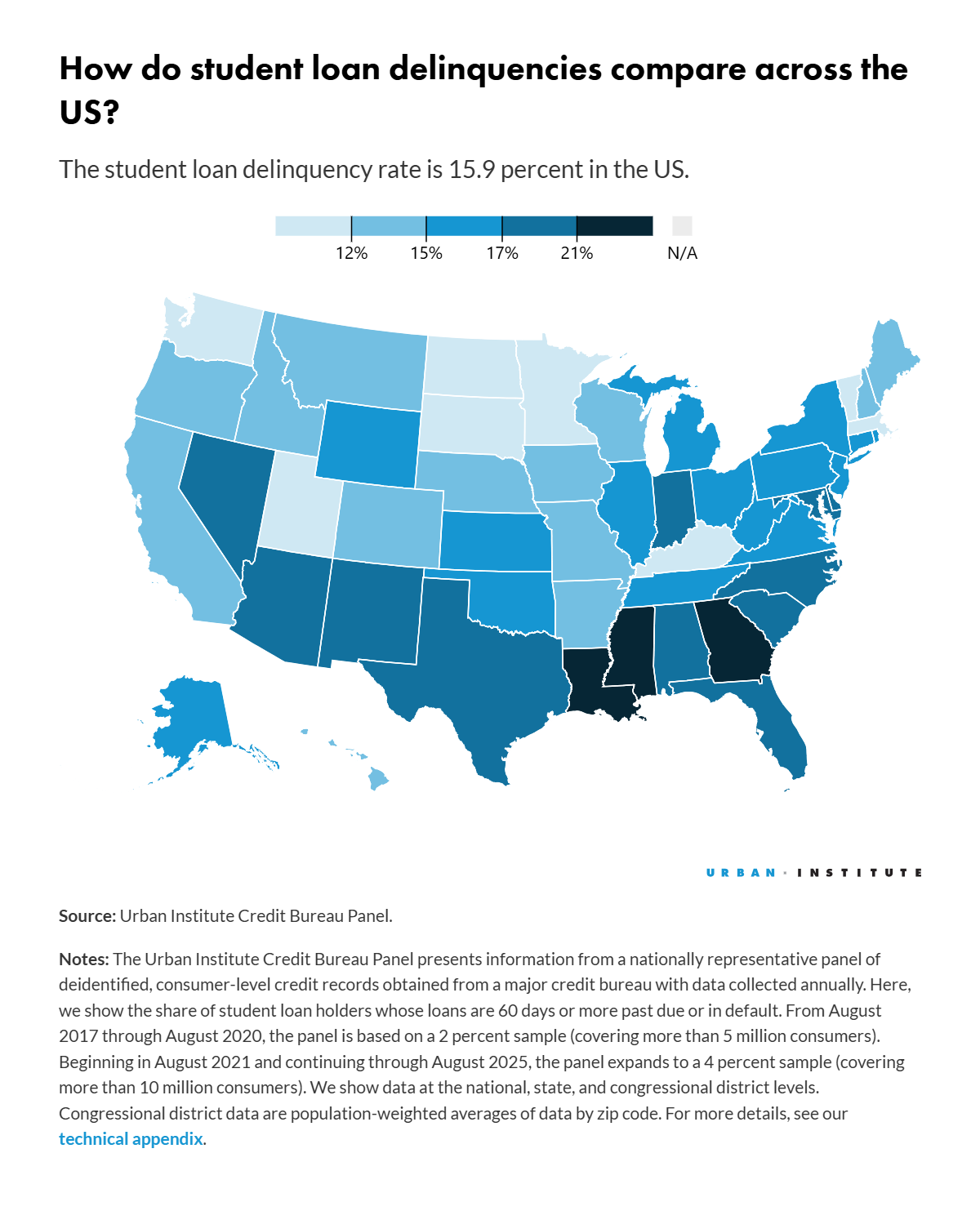

New credit reporting data from the Urban Institute’s Debt in America interactive map show roughly 6 million people are at least 60 days late on their payments, a return to prepandemic levels. Delinquency rates are especially high in parts of the South, with more than 1 in 5 borrowers in Louisiana, Mississippi, and Georgia past due on their student loans.

Rising student loan debt and delinquency may exacerbate many Americans’ concerns around affordability and costs of living, as borrowers may have to choose between making a student loan payment and paying for other daily necessities.

During the COVID-19 pandemic, the federal government placed nearly all federally held student loans into forbearance, suspending payments and temporarily setting interest rates to zero. This relief lasted more than three years, providing breathing room for borrowers, especially those facing job losses or reduced hours. It also allowed borrowers to take on other forms of debt, such as mortgages, credit card loans, and auto loans.

The payment pause ended roughly two years ago, when interest began accruing in September 2023 and payments were due the following month. To soften the transition, the US Department of Education introduced the Saving on a Valuable Education (SAVE) plan, an income-driven repayment program designed to lower monthly payments for many borrowers, and established a one-year “on-ramp” period during which missed payments would not be reported to credit bureaus or accrue toward default.

However, SAVE is currently enjoined by court order, with the more than 7 million borrowers on the plan in general forbearance. Further, the on-ramp protections ended in October 2024, and delinquencies started showing up on credit reports in early 2025.

Using Urban Institute credit bureau data from August 2025, our Debt in America map paints a clear∥nd concerning}icture of where student loan delinquency is most widespread. About 16 percent of student loan borrowers nationwide are 60 or more days late on their payments, representing nearly 6 million Americans.

Southern states have the highest delinquency rates, with Louisiana (22.6 percent), Mississippi (22.3 percent), and Georgia (21.1 percent) topping the list. These states also generally have lower median incomes and higher shares of borrowers who did not complete a degree: two key risk factors for repayment difficulties.

States like Kentucky (10.1 percent), Minnesota (10.6 percent), and North Dakota (10.8 percent) report the lowest rates of student loan delinquency, highlighting sharp geographic disparities.

Falling behind on student loan payments can have long-lasting consequences for borrowers. Delinquency can significantly lower a borrower’s credit score, making it harder to qualify for credit cards, auto loans, or mortgages. And delinquencies of longer than 270 days lead to default, which can result in wage garnishment, offset of tax refunds, and loss of eligibility for future federal aid programs.

As policymakers and advocates consider how to address rising delinquency rates, the following strategies could help borrowers avoid further delinquency and default.